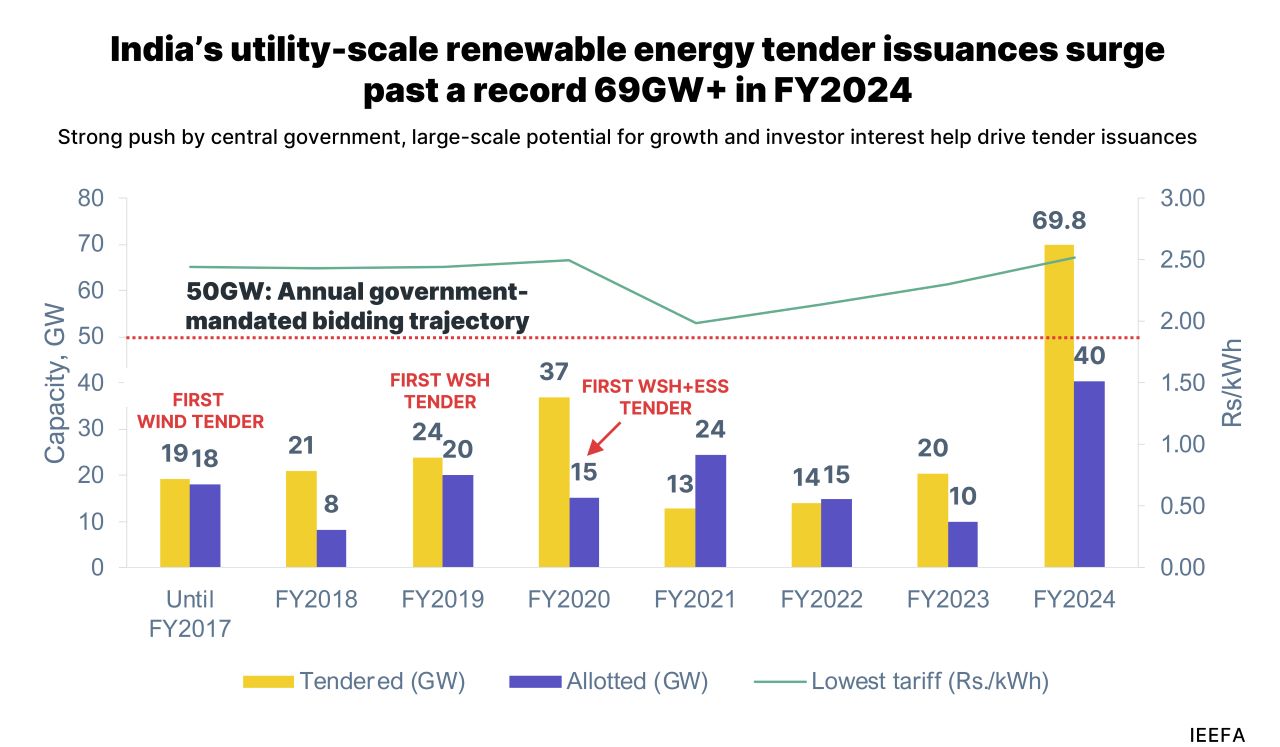

India has more than trebled utility-scale renewables tender capacity to 69.8GW in fiscal year 2024, 48% of which from solar PV.

Out of the nearly 70GW of capacity tendered from 1 April 2023 until 31 March 2024, 40GW ended up being awarded, according to a report from the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research & Analytics. This represents a fourfold increase from FY23 when only 10GW of capacity ended up allotted, while the capacity tendered in FY24 surpassed the government’s target of 50GW. It is expected that for FY25, tenders will again surpass the 50GW government threshold, with awarded capacity to further increase.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Solar tariffs have increased marginally by nearly 8.5% in the past two years, from an average of INR2.3-24/kWh (US$0.027-0.0287/kWh) to INR2.5.26/kWh, despite module prices decreasing by 57% during the same period.

A quarter of the nearly 70GW of renewable capacity tendered came from Indian utility Solar Energy Corporation of India (SECI), highlighting the importance of state-level tendering authorities’ role in the deployment of utility-scale renewables.

Since the introduction of hybrid tenders in 2018, solar-wind hybrid share has increased from 16% in FY20 to 43% in FY24, while solar as a standalone accounted for nearly half of all capacity tendered during FY24.

“There is strong investor interest in the Indian utility-scale renewable energy market. The primary reasons are the large-scale potential for market growth, central government support in terms of targets and regulatory frameworks, and higher operating margins,” said, Vibhuti Garg, Director – South Asia at IEEFA and contributing author of the report.

Despite the increased capacity tendered and awarded during FY24, challenges still persist in the execution of the tenders.

Chief among them are the 40% import duties on solar modules introduced with the basic customs duty in April 2022 and the requirement to procure domestically-manufactured components, through the Approved List of Models and Manufacturers (ALMM). The ALMM was recently reinstated after a one-year moratorium due to an inadequate supply of domestic-made components.

According to the report, India had 68GW and 8GW of module and cell annual nameplate capacity, respectively, as of April 2024. However, actual production capacity is much lower with only 17GW of module shipments in 2023 by Indian manufacturers.

Moreover, over 10 new developers entered the Indian utility-scale market in the past couple of years, including US independent power producer BrightNight who partnered with energy platform ACEN Corporation to ramp up the development of its 1.2GW renewables portfolio in India.