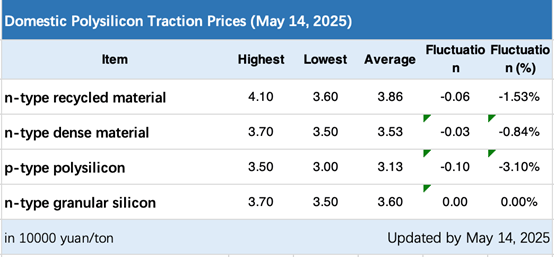

On May 14, the Silicon Industry Branch released the latest polysilicon prices, noting that while polysilicon companies initiated contract signings for moderate volumes this week, prices continued to decline slightly.

According to the pricing data, n-type recycled material transacted at RMB36,000–41,000/ton (US$4,994-5,689/ton) – with an average of RMB38,600/ton and a week on week drop -1.53% WoW, n-type granular silicon at 35,000–37,000 yuan/ton (avg. 36,000 yuan/ton, flat WoW), and p-type polysilicon at 30,000–35,000 yuan/ton (avg. 31,300 yuan/ton, -3.10% WoW).

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The Silicon Industry Branch noted that the primary drivers behind this week’s slight decline in polysilicon market prices are persistently high inventory levels and the sharp drop in downstream product prices.

From an industry inventory perspective, current supply and demand are barely balanced on a monthly basis. If downstream production continues to decline, the polysilicon sector may face monthly inventory accumulation due to inflexible production line adjustments.

In terms of production, data from the Silicon Industry Branch shows that as of the week ending May 15th, two companies had entered maintenance shutdowns, reducing the number of active producers to 11. Statistics show that in April 2025, China’s polysilicon output was 99,100 tons, down 6.08% month-on-month. There has been a surge of news regarding polysilicon recently, with frequent shifts in market expectations. Actual implementation details will depend on the official company announcements.

TrendForce’s latest pricing reports also indicate that Chinese silicon prices have fallen across the board, while wafer prices have continued to fall.

In the week of May 15, the latest RMB price for n-type 182mm monocrystalline wafers was RMB0.95/piece, down 6.86% from RMB1.02/piece the previous week. The price for n-type 210mm monocrystalline wafers slightly dropped from RMB1.32/piece to RMB1.3/piece. The latest quote for n-type 210R monocrystalline wafers stood at RMB1.1/piece.

In cell pricing, the RMB price for M10 monocrystalline TOPCon cells stood at RMB0.26/W; the RMB quote for G12 monocrystalline TOPCon cells was RMB0.28/W; the transaction price for G12R monocrystalline TOPCon cells fell to RMB0.26/W, down 1.89%.

This week, quotes for Chinese centralised projects using 182-210mm TOPCon modules stabilised, with the average price holding at RMB0.69/W. The distributed average price stabilised at RMB0.67/W.

The price range for bifacial M10-TOPCon modules from leading manufacturers ranges between RMB0.64-0.72/W, with the price midpoint shifting downward. For bifacial G12-HJT modules, the mainstream manufacturer quotations are in the range of RMB0.68-0.76/W.

TrendForce noted that manufacturers are currently engaged in widespread price cuts, and with the demand vacuum in Q2, price stabilisation remains unlikely unless upstream players impose extraordinary production curbs.

TrendForce stated that manufacturers are currently broadly lowering prices, and with the demand vacuum in Q2, there is no sign of price stabilisation unless upstream players implement unconventional production restrictions.